Anyone else noticed Vietnam’s macro/market disconnect?

30 Dec 2014

Dear All,

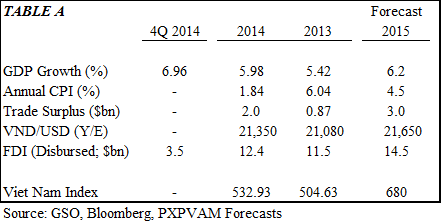

Vietnam’s 2014 year-end macro data releases (see table below) paint a picture of an economy in robust health and yet the stock market continues to languish less than 5% higher in USD than where it started the year. Much of the “rationale” behind the recent weakness can be laid at the door of the Petrovietnam stable (GAS, for example, doubled and then halved this year, the latter move from an index weighting of roughly 23%), but the current malaise is also attributable to the vicious cycle of weakness leading to margin calls leading to further weakness leading to further margin calls, and so on. Nothing much to do with fundamentals, in other words.

Although fairly predictable in a market with a sometimes scarily homogenous and largely fundamentally disinterested investor base, recent weakness has once again delivered an interesting entry opportunity for anyone with an investment horizon extending into at least 2015.

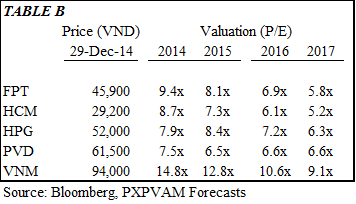

Rather than bore you with a year-end marketing pitch for a closed-end fund about to merge with an open-ended fund and vice versa the tables below outline both the macro (Table A) and the 2014 to 2017 valuations of our 5 favourite stocks (Table B), based on our in-house research. Notwithstanding whether anyone else forecasts that far out in this market for as many stocks as we do, what you choose to do with the information is entirely your call; we will limit ourselves to wishing you a very Happy (Gregorian) New Year and hoping that 2015 brings logic (and higher foreign ownership limits) to Vietnam, allowing the stock market to begin to fulfil some of the potential already evident in its continuing macroeconomic progress.

All the best for 2015 from the PXP Team.